child tax credit september date

Benefit payment dates Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022 February 18 2022 March 18 2022. 15 opt out by Aug.

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child.

. September 18 2021 228 PM 6 min read. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started. As part of the American Rescue Act signed into law by President Joe Biden in.

Ad Receive the Child Tax Credit on your 2021 Return. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Payments will start going out on September 15 More than 30million households are set to receive the payments worth up to 300 per child starting September 15.

Many parents continued to post their frustrations online Friday about not receiving their September payments yet for the advance. Ontario Energy and Property. Advance payments will continue next month and through the end of the year thanks to the American Rescue Plan.

Child tax credit payments are due to come in. By Jackie Annett 1400 Wed Sep 14 2022. Complete Edit or Print Tax Forms Instantly.

15 and while most households have received their payments not all households have been so lucky. Learn More At AARP. The IRS said Wednesday that Septembers payments totalling nearly 15.

The IRS issued a formal statement on September 24 which anyone missing their September payment should read. The last Child Tax Credit check was issued on Sept. This months payment will be sent on September 15.

Under the American Rescue Plan most eligible families received payments dated July 15 and Aug. The latest payment schedule information will be updated on 26 August to show that the first tax credit payments will be made between 2 and 7 September. 30 thanks to the 1992 Taxpayers Bill of Rights TABOR Amendment.

The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent childrenIt provides 2000 in tax relief per qualifying child with up to 1400 of that. MILLIONS of benefits claimants will be paid on a different date in September because of the bank holiday for the Queens funeral. Learn about the New Brunswick Child Tax Benefit including the payment dates how to apply and how to receive the New Brunswick Benefits.

Ad Access IRS Tax Forms. September Advance Child Tax Credit Payments. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

The majority of payments will be issued by direct deposit. Visit ChildTaxCreditgov for details. The third round will be paid out by direct deposit or paper check beginning on Wednesday Sept.

The first two checks were sent out in July and August but theres still another to come in September and the following months. IR-2021-153 July 15 2021. Taxpayers who either qualify for the Empire State child credit or the earned income credit of at least 100 or both will qualify for the new stimulus check from New York.

The Department for Work and Pensions DWP and HM Revenue and Customs HMRC have confirmed benefit payment due on 19 September 2022 will be paid early. Theres Still Time to Get the Child Tax Credit If you havent yet filed your tax return you still have time to file to get your full Child Tax Credit. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

To be a qualifying child for the 2021 tax year your dependent generally must. File Federal Taxes to the IRS Online 100 Free. State residents who have filed their 2021 return by June 30 will get a physical check for 750 by Sept.

Eligible parents will receive 300 per child aged six or younger and 250. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

The DWP has confirmed that like on other bank holidays you should instead receive benefits including Universal Credit child benefit and tax credit three days earlier on. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The IRS has announced the September child tax credits are on their way and future payment dates.

13 opt out by Aug.

How To File Your Employee Retention Credit Sept 2022

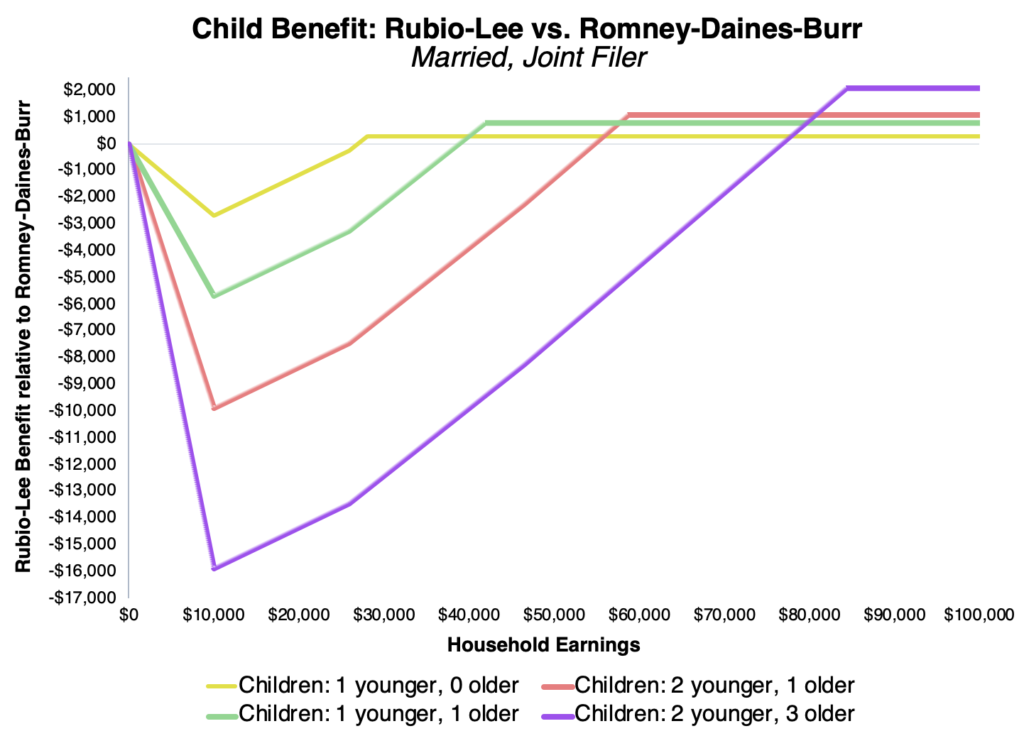

Comparing Rubio And Romney S Child Benefit Proposals Niskanen Center

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

State Stimulus Payments 2022 Is Your State Sending Out Checks This Week Cnet

2021 Child Tax Credit Advanced Payment Option Tas

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

The Advance Child Tax Credit Changes Coming

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Schedule Date Of Gst Return Filling For Regular Business Accounting And Finance Accounting Course Filing Taxes

What Michigan Needs To Know About The July 15 Child Tax Credit Payments Bridge Michigan

Low Income Housing Tax Credit Ihda

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet